Your trusted partner in Investment solutions.

Expert Financial Marketing Advice

At Cover India By Satvik Enterprises, we believe in protecting what matters most—your assets, and your future.

Mutual Fund Investments

Grow Your Wealth. Secure Your Future.

At Cover India Satvik Enterprises, we believe that investing shouldn’t be complicated—it should be smart, transparent, and aligned with your goals. Our Mutual Fund Investment services help individuals and families grow their wealth through expert guidance and customized portfolio planning.

Whether you're just starting or looking to diversify, we’ll guide you every step of the way.

Fixed income funds

You can choose to invest for a fixed rate of return through options such as government bonds, investment-grade corporate bonds, and high-yield corporate bonds, all offered at the best rates to match your preferences.

Balances funds

Our company’s goal is to deliver higher returns while acknowledging the risk of potential loss. These funds combine a balanced mix of equities and fixed-income securities.

Your Dedicated Agent

Available on one call

24 hours every day

What is a Mutual Fund?

A mutual fund pools money from multiple investors and invests in a diversified portfolio of stocks, bonds, or other assets, managed by professional fund managers. It’s one of the most accessible and efficient ways to build long-term wealth with reduced risk.

What Else Can Mutual Funds Do?

Save on Taxes — Yes, It’s Possible!

By investing in ELSS (Equity Linked Savings Scheme), you can enjoy attractive tax deductions. Mutual fund portfolios cater to a variety of investment goals, from index-linked funds to target-date funds designed to match market benchmarks.

With the expertise of professional fund management, investors can maximize their tax-saving opportunities by strategically diversifying into tax-efficient options like ELSS. With FundsIndia, you can explore the diverse world of mutual fund investing while unlocking the potential tax benefits that ELSS has to offer.

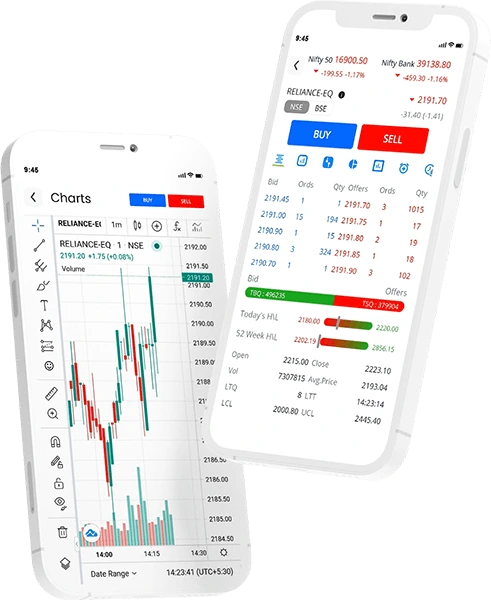

Start Investing in Mutual Funds Commodities Stocks F&O IPO

Why Invest with Cover India?

📊 Diversification – Lower risk by spreading investments

⏱ Convenience – Professionally managed by experts

💰 Affordability – Start with as little as ₹500/month

📈 Growth Potential – Beat inflation & create long-term wealth

🧾 Tax Benefits – Under Section 80C (ELSS funds)

🔄 Liquidity – Withdraw when needed (except for lock-in funds)

Documents Required:

PAN Card

Aadhaar Card

Canceled Cheque (for SIP mandate)

KYC Documents

Nominee Details (optional but recommended)

Why Invest with Cover India?

Goal-Based Planning for retirement, education, or wealth building

Risk Profiling to match your comfort zone and timelines

Fund Comparison & Selection from top-rated AMCs

Regular Portfolio Reviews and rebalancing

Personalized Support from certified investment advisors

Diversification Reduces Risk

Mutual funds invest in a variety of stocks, bonds, or other securities. This spreads your investment across multiple assets, reducing the impact of poor performance from any one of them.

Professionally Managed

Your money is managed by expert fund managers who research the market, select the best investment opportunities, and monitor performance — so you don’t have to.

Flexible & Accessible in mutual fund

Start with small amounts through SIPs (Systematic Investment Plans), withdraw anytime in open-ended funds, and choose from different types (equity, debt, hybrid) based on your financial goals.

A mutual fund is a professionally managed investment vehicle that pools money from many investors to buy stocks, bonds, or other securities. Each investor owns units, which represent a portion of the holdings.

Mutual funds are regulated by SEBI (Securities and Exchange Board of India) and offer a range of risk options. While returns aren’t guaranteed, diversified portfolios and expert fund management reduce risk over the long term.

You can start investing in mutual funds with as little as ₹500/month through a SIP (Systematic Investment Plan). There’s no large capital needed to begin.

A SIP (Systematic Investment Plan) allows you to invest a fixed amount regularly—monthly or quarterly—into a mutual fund. It's ideal for long-term wealth creation and brings discipline to investing.

- Equity Funds invest in shares and offer higher returns with higher risk.

- Debt Funds invest in bonds and offer steady returns with lower risk.

Hybrid Funds combine both for balanced growth.

Yes, most mutual funds are open-ended, allowing you to redeem units anytime. However, certain funds like ELSS have a lock-in period (3 years).

Yes, returns are subject to capital gains tax:

- Short-Term Capital Gains (STCG): Taxed if sold before 1 year (for equity funds).

Long-Term Capital Gains (LTCG): Exceeding ₹1 lakh/year taxed at 10% (for equity).

Debt fund taxation differs—our advisors will guide you based on your fund type.

You need:

- PAN Card

- Aadhaar Card

- Canceled Cheque (for SIP)

- Address Proof

KYC Compliance

We provide a client dashboard, email updates, and personalized portfolio reports. You can also use mobile apps or official AMC websites to monitor performance.

No. Mutual funds do not require a Demat account. Investments are tracked using your Folio Number provided by the Asset Management Company (AMC).

Yes, Know Your Customer (KYC) is mandatory. It involves verifying your identity and address. We help you complete KYC seamlessly before your first investment.

Yes, you can pause, increase, decrease, or stop your SIP at any time with a simple request. It offers great flexibility based on your financial situation.

Need any help!

We're here for you every step of the way! Whether you’re choosing the right insurance plan, need help with claims, or just have a quick question — our experts at Cover India by Satvik Enterprises are ready to assist you.

Your Dedicated Agent